This report contains stories of individuals and families across Alabama who have fallen into this trap.

Want to read this in PDF form? Click here.

Executive Summary

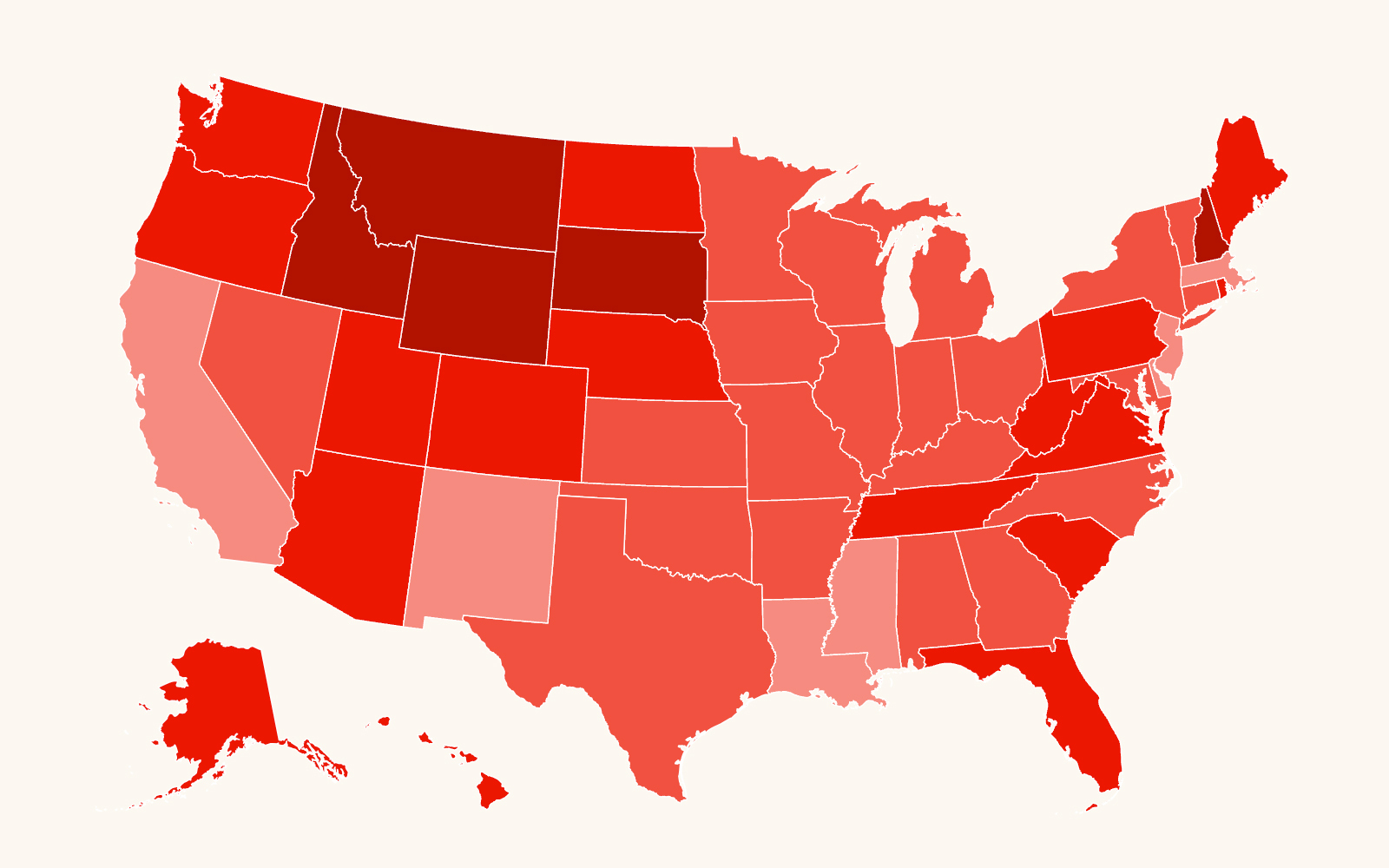

Alabama has four times as many payday lenders as McDonald’s restaurants. And it has more title loan lenders, per capita, than any other state.

This should come as no surprise. With the nation’s third highest poverty rate and a shamefully lax regulatory environment, Alabama is a paradise for predatory lenders. By advertising “easy money” and no credit checks, they prey on low-income individuals and families during their time of greatest financial need – intentionally trapping them in a cycle of high-interest, unaffordable debt and draining resources from impoverished communities.

Although these small-dollar loans are explained to lawmakers as short-term, emergency credit extended to borrowers until their next payday, this is only part of the story.

The fact is, the profit model of this industry is based on lending to down-on-their-luck consumers who are unable to pay off loans within a two-week (for payday loans) or one-month (for title loans) period before the lender offers to “roll over” the principal into a new loan. As far as these lenders are concerned, the ideal customer is one who cannot afford to pay down the principal but rather makes interest payments month after month – often paying far more in interest than the original loan amount. Borrowers frequently end up taking out multiple loans – with annual interest rates of 456% for payday loans and 300% for title loans – as they fall deeper and deeper into a morass of debt that leaves them unable to meet their other financial obligations. One study found, in fact, that more than three-quarters of all payday loans are given to borrowers who are renewing a loan or who have had another loan within their previous pay period.

As the owner of one payday loan store told the Southern Poverty Law Center, “To be honest, it’s an entrapment – it’s to trap you.”

Remorseful borrowers know this all too well.

This report contains stories of individuals and families across Alabama who have fallen into this trap. The Southern Poverty Law Center reached out to these borrowers through listening sessions and educational presentations in various communities across the state. We also heard from lenders and former employees of these companies who shared information about their profit model and business practices. These stories illustrate how this loosely regulated industry exploits the most vulnerable of Alabama’s citizens, turning their financial difficulties into a nightmare from which escape can be extraordinarily difficult.

As these stories show, many individuals take out their first payday or title loan to meet unexpected expenses or, often, simply to buy food or pay rent or electricity bills. Faced with a money shortage, they go to these lenders because they are quick, convenient and located in their neighborhoods. Often, they are simply desperate for cash and don’t know what other options are available. Once inside the store, many are offered larger loans than they requested or can afford, and are coaxed into signing contracts by salespeople who assure them that the lender will “work with” them on repayment if money is tight. Borrowers naturally trust these lenders to determine the size loan they can afford, given their expenses, and for which they can qualify. But these lenders rarely, if ever, consider a borrower’s financial situation. And borrowers do not understand that lenders do not want them to repay the principal. Many times, they are misled about – or do not fully understand – the terms of the loans, including the fact that their payments may not be reducing the loan principal at all. The result is that these loans become financial albatrosses around the necks of the poor.

It doesn’t have to be – and shouldn’t be – this way. Commonsense consumer safeguards can prevent this injustice and ensure that credit remains available to low-income borrowers in need – at terms that are fair to all.

The Alabama Legislature and the Consumer Financial Protection Bureau must enact strong protections to stop predatory lenders from pushing vulnerable individuals and families further into poverty. Our recommendations for doing so are contained at the end of this report.

Tricks of the Trade

Payday and title lenders prey on low-income and impoverished people at their time of greatest need.

And their business model depends on borrowers who make only interest payments repeatedly without whittling down the principal – often paying far more in interest than they borrowed in the first place.

With title loans especially, many consumers don’t even know, and are shocked to find out, that they’re not paying down the principal when they make regular payments.

John*, who has been in the payday loan business in Montgomery for nearly a decade, said he earns $17.50 in interest for each $100 he lends for a two-week period. With his loans limited to $500 per customer, that’s not enough to make his business worthwhile. But if the customer cannot repay the principal, he continues to earn $17.50 twice each month on the original loan, while the principal remains untouched.

He estimates that 98% of his customers don’t pay back the loan right away, typically because to do so would mean they couldn’t pay their other bills.

“I bank on that,” John said. “It’s put my kids through school. When they come in and they say, ‘I just want to pay my interest,’ yeah, I got them. Once you pay it once, you’re going to be doing it again.”

He typically offers borrowers more money than they ask for, knowing the more they take, the harder it will be to pay off unless they don’t pay their rent or utilities.

“To be honest, it’s an entrapment – it’s to trap you,” he said.

John told of one customer, for example, who paid $52.50 in interest every two weeks for a $300 loan – for two years. That equals $2,730 in interest alone.

National data tells the same story. More than three-quarters of all payday loans are given to borrowers who are renewing a loan or who have had another payday loan within their previous pay period. This means that the vast majority of the industry’s profit is derived from loans where the borrower is obtaining no new principal.

When customers do manage to pay off the loan, they frequently come back for another one. Studies show that borrowers are indebted for an average of five to seven months per year. John and his salespeople encourage that.

“The payday loan system has made my lifestyle quite easy, I guess you could say,” John said. “There’s enough money out there for everybody if you want to do this kind of business.”

Those who work in payday or title loan stores are under heavy, constant pressure to lend money to people they know will soon be trapped in debt they cannot pay off. Tiffany* worked in a store in Mobile that offered both payday and title loans. She said employees were graded on their “check count,” or number of loans they had outstanding. (Borrowers are typically required to leave a check with the lender so that if they default, the lender can attempt to cash the check to recoup the principal, interest and any fees that might apply.) “When a borrower pays in full and doesn’t renew, you lose a check,” she said. “They don’t want you to ever drop checks, and if you do, they want to know why.”

Most of the employees she knew earned between $8 and $10 an hour, plus commissions based on the number of outstanding loans they had. If she had 300 loans outstanding, her bonus would double.

“You get emails all day long: ‘Grow the business or find another job,’” Tiffany said.

Some customers, she said, carried the same payday loan for years, making only interest payments. “They could have bought a car or two with that interest money by now.”

No longer working in the business, Tiffany said she felt horrible seeing what happened to customers mired in debt. She believes that shutting down these lenders would be good for the communities they prey upon.

“These people are really trying,” she said. “They’re just everyday, hardworking people.”

The following are features of the payday and title loan industry that harm consumers:

EXORBITANT INTEREST RATES

Low-income families and individuals pay effective annual interest rates of 456% for payday loans and 300% for title loans. The industry and the law express the interest rate as 17.5% for payday loans and 25% for title loans each loan period. Most borrowers have outstanding loans for many pay periods, and the high interest rates are not tied to the risk associated with these loans. This is especially evident with title loans, because the loan is secured by a car valued at an amount greater than the principal loan amount.

Title loan interest rates can be devastating for borrowers like Cierra Myles in Dothan. Her car, for which she had paid $1,200 a few months earlier, was repossessed when she was late making a $129 monthly payment on a $700 title loan. “I feel embarrassed and upset every time I see my car behind that fence,” she said.

LENDERS ENCOURAGE HIGHER PRINCIPAL

Lenders often offer customers more money in loans than they request.

John, the payday lender cited earlier, said he would put money on the counter and say, “Look, this is what you’re approved [for]. You can take this, or I can put $200 back in my pocket. You can walk out the door with it.” Most people take the money.

Borrowers are limited by law to $500 in outstanding payday loans at any time. However, payday lenders do not have a centralized database to determine whether borrowers have loans with other lenders, so many borrowers’ total debt load exceeds $500. Title loans have no maximum loan amount; instead, they are extended based on the value of the car. The 300% annual interest rate drains thousands of dollars in interest payments from families and individuals every year.

Latara Bethune, a hair stylist in Dothan, was offered almost double what she asked for at a title loan shop in her neighborhood. She hesitated, but the employee persuaded her to take the extra money. The agreement she signed required her to pay back, over 18 months, approximately $1,787 for a $400 loan.

UNLIMITED RENEWALS

When a loan quickly comes due and the borrower cannot repay the full amount, the lender can renew, or roll over, the loan, charging an additional interest payment. Lenders intend for borrowers to be unable to repay and to roll over their loans after their first payment is due.

Often, title loan borrowers do not understand that their payments are covering only the interest.

“People would cry,” said Tiffany, the former payday and title loan employee. “They said, ‘I’ve been doing this for a year, why isn’t this done?’ They really didn’t understand. Once I explained it, they were heartbroken. They thought they were working towards a goal, but they weren’t.”

REPAYMENT PERIOD TOO SHORT FOR MEANINGFUL OPPORTUNITY FOR ON-TIME REPAYMENT

Borrowers are required to pay back payday loans by their next pay period. Title loans are expected to be repaid within 30 days. But for borrowers using these loans to pay for routine expenses, it is frequently impossible to repay the full amount of the loan plus interest in such a short period without needing additional funds to pay their bills. Borrowers are almost never able to get ahead and pay back the principal with such high interest payments every week. Studies show that nationwide, 76% of all payday loans are taken out by borrowers who have paid off a loan within the previous two weeks.

Despite the fact that title loans are often extended with principal values of thousands of dollars, borrowers are given only 30 days to repay the principal and interest of up to 25%. If the borrower does not repay the full amount, the lender may decide whether to extend the loan for another month. The title loan borrower is at the mercy of the lender, as the lender may repossess the car at the end of any 30-day period in which the full amount of the loan is not repaid – even though the vehicle may be worth thousands of dollars more than the borrower owes.

NO VERIFICATION OF ABILITY TO REPAY

Most title lenders do not ask for any proof of income or whether the borrower has other obligations. While payday lenders often ask for some proof of income and a bank account, there is no meaningful assessment of a borrower’s ability to repay the loan. Studies show that 69% of borrowers use payday loans to meet everyday expenses, such as rent, bills, medicine and groceries. Many individuals present lenders with only their Social Security income or disability checks as proof of income. While these checks are sometimes enough to cover basic expenses, seniors on Social Security rarely have an opportunity for extra income, making them among the most vulnerable to being trapped in the payday loan debt cycle.

Tiffany said lender employees were encouraged to make loans to Social Security recipients, because they made their interest payments on time and were unlikely to be able to pay back the principal. Edward*, an 89-year-old retiree in Birmingham, was a prime example. He borrowed $800 against his 1996 Buick Riviera to help out a younger relative, understanding that he would pay back a total of $1,000 with interest. But after paying $1,000 over five months, he was informed that he had only been paying the interest and still owed the original $800. Angry, he refused to pay any more, and the lender repossessed the vehicle.

Lenders do not verify borrowers’ ability to repay, because their goal is to extend loans that borrowers cannot pay back and force them to renew. For payday loans, Tiffany said she was able to lend up to 30% of someone’s paycheck. That meant that if someone were to pay off the entire principal and interest in two weeks, they would need to take almost half of their paycheck back to the lender. “According to the financial records they gave me, they qualified according to [the lender’s] standards,” Tiffany said. “According to my personal standards and morals, no, they don’t qualify, because they can’t pay this back ever.”

NO INSTALLMENT PLANS OFFERED

Title loan lenders offer only one option for borrowers who cannot repay the full amount of their loan: rolling over the loan every 30 days. If the lender does not agree to roll the loan over, the car is repossessed.

The law allows but does not require payday lenders to offer a repayment option of four equal monthly installments, with no new interest, if the lender cannot pay on the day that the loan is due. The option is usually offered only when the borrower specifically asks for it. Industry professionals agree that offering such a plan is a “best practice,” but only if the customer informs the lender that they are unable to repay the loan the day before it is due.

Tiffany noted that she was not allowed to offer this program to borrowers unless they specifically requested it, and very few customers knew enough about the law to ask for such a plan. However, Tiffany noted that the few customers to whom she was able to provide this plan repaid their loan without incident. She believed this payment plan was much fairer and wished she could offer it to more borrowers to help them escape their debt.

COMMISSION PAYMENTS TO EMPLOYEES

In order to ensure that individual employees are following the profit model outlined above, lenders pay employees based on the amount of current loans outstanding, not including any loans in collections or past due. This encourages employees to persuade borrowers to take out loans with high principal values and to continue rolling over their loans when they are due. This also encourages employees to use any tactics necessary, including deception, threats and other abusive techniques, to collect the money owed.

Latara Bethune of Dothan said she was threatened by a title lender employee. The employee told her that if Latara did not hand over the keys to her car, the employee would call the police and accuse Latara of stealing.

Borrowers are sometimes even threatened with criminal charges and jail time for failure to pay their loans.

DECEPTIVE EXPLANATIONS OF CONTRACTS, ESPECIALLY FOR TITLE LOANS

Payday lenders frequently do not explain many of the terms of the contract, including stipulations requiring borrowers to agree to mandatory arbitration and to waive their right to a jury trial in the event of a dispute. The contracts are often long and confusing to borrowers, many of whom say they have the most trouble with title loan contracts.

John, for example, does not allow his customers to take contracts home to read them in depth. He said he knows they will not read the contract, or at least the important part buried in the middle. “The first two paragraphs [are] just not very important,” he said. “That third paragraph is the one that you need to read.”

Title loan contracts state that the loan is for 30 days only. However, employees extending these loans often tell consumers they can have as much time as they want to pay off the loan. Many explain only that the borrowers will have to make a “minimum payment” every month, which is equal to the interest due each month and does not include any partial repayment of the principal. Tiffany, for instance, was instructed by her employer that she should never talk about the principal when explaining the monthly payments to a potential borrower. Lenders also do not explain that they can, at any time, refuse to roll over the loan and can repossess the car if the borrower does not pay the full amount of the loan by the end of any 30-day period. Lenders also impose late fees and repossession fees that are not clearly explained, either orally or in writing.

DIRECT ACCESS TO BANK ACCOUNTS OF PAYDAY LOAN BORROWERS

Because payday loan borrowers are required to provide lenders with a postdated check or a debit authorization, lenders have direct access to their bank accounts and can try to collect at any time after the loan term expires. Cashing these checks may result in additional fees for the borrower, including overdraft or insufficient fund fees from the bank and bad check fees from the lender of up to $30.

Lenders’ direct access to borrowers’ bank accounts also allows them to evade federal protections against garnishment of Social Security benefits. This also ensures that lenders stay out of court, where the fees charged and terms of the loan would need to be approved by the court before a judgment is awarded to the lender.

These factors provide additional coercion for borrowers to roll over their loans multiple times, even if the loan does not comply with the law.

HOLDING CAR AS COLLATERAL IN TITLE LOANS

Title loan borrowers can be forced to pay interest for months or years, as otherwise lenders can take from them one of their most valuable possessions. Borrowers in Alabama – where public transportation is inconvenient, unreliable and, in many places, simply unavailable – need cars to get to work, transport their children to school, and do other daily errands.

BUYOUTS OF OTHER TITLE LOANS

When a title loan borrower falls behind on payments and wants to avoid repossession, some lenders will offer to pay off the borrower’s existing loan and extend a new loan. The principal balance on the new loan thus becomes the total amount due on the old loan, including principal, interest and any late fees or other charges that have accumulated. The new lender may also encourage the borrower to borrow additional money. This causes the interest payments to increase dramatically.

This highly predatory practice shows that lenders are not attempting to lend responsibly but rather are choosing to extend additional funds to consumers who have demonstrated an inability to repay a smaller loan. Lenders, in fact, target consumers who cannot afford to pay off their loans but who will do anything they can and make as many interest payments as possible to avoid losing their cars.

RETAINING SURPLUS FROM VEHICLE SALE IN TITLE LOANS

When lenders repossess and sell a borrower’s car, they never return any surplus that exceeds the amount due on the loan. Some borrowers may have paid thousands of dollars in interest and principal by the time the car is repossessed. They lose this money and their car.

MANDATORY ARBITRATION

Many of the contracts for these loans contain mandatory arbitration clauses that prevent consumers from challenging the terms of these loans in court, either through individual actions or class actions.

* NOT HIS REAL NAME.

Victimized

ALICIA* BIRMINGHAM

Recent nursing school graduate Alicia was working hard to support her daughter, who was in college.

She thought a short-term loan would provide some relief from her tight expenses. But because of her other debt, Alicia was sure no bank or credit union would lend her the money. So she went to a payday lender in her neighborhood and took out a $500 loan.

“It was the simplicity of the transaction that made it enticing,” Alicia said.

She renewed the loan seven times because she could only afford to pay the $85 interest payment every two weeks, and eventually paid $595 in interest. She also took out two more $500 loans.

Alicia had to work extra shifts at the hospital to sustain her loans and eventually pay them off. She was too ashamed to talk about her debt or ask family members or friends for help.

“Everyone around me assumed I was doing great, which made me feel like a liar,” she said.

In total, Alicia repaid $2,945 to borrow $1,500 for just a few months. She feels lucky that she was able to break out of her debt and hopes others can as well.

“Some people may feel, as I did, that this business is their only option,” she said. “Unfortunately, there is no counseling, and without a steady income or an opportunity to increase income, it is impossible to break free.”

RUBY FRAZIER DOTHAN

Ruby’s daughter’s asthma was getting worse, and she couldn’t keep up with the weekly treatments along with her other bills. So Ruby, who at 68 was suffering from heart problems and didn’t have any extra money to help, decided to use her pickup truck to secure a loan for her daughter from a title lender in Troy.

She gave the money to her daughter, who promised to pay it back monthly.

Soon afterward, Ruby and her daughter asked a lender in Dothan to buy out the loan. The store extended a new loan with a principal value of $2,218.14 to cover the principal and interest due from the first one. Ruby was sure her daughter was taking care of the payments until she got a surprise call from a lender employee who told her the total value of the loan was up to $3,000, and it needed to be paid off immediately.

The lender would not accept partial payments or offer a monthly payment plan but instead sued her in small claims court to recover the money. Ruby argued in response that she didn’t owe $3,000. But without her knowledge, the lender obtained a judgment. A sheriff’s deputy soon arrived at her house and took her husband’s car, which was worth $3,200 but was not the vehicle she had used to secure the loan.

Ruby obtained legal help to fight the repossession. The judge ordered that the sheriff’s office must return the car. Even after this ruling, the sheriff’s office refused to return the car unless she paid a $200 repossession fee. That, too, was struck down by the judge.

Ruby believes that lawmakers must provide additional protections for consumers. “I wouldn’t allow them to have those loans, unless they did it more fairly. The way it is now, I wouldn’t even allow that.”

The experience shook her both financially and personally.

“I go by what God said: ‘Thou shalt not steal.’ And that’s stealing. It is.”

JOAN* MONTGOMERY

Joan and her husband never borrowed money. But when they struggled to pay their power and doctors’ bills, they turned to a payday lender in their neighborhood. As proof of income, they used Joan’s Social Security award letter. She received $524 per month, her only source of income.

The payday lender offered Joan a $100 loan.

Joan, who was then 54, knew that the money wouldn’t cover her expenses, so she obtained two other loans from payday lenders that same day – one for $150 and another for $100. Neither lender asked whether she had additional outstanding loans or about her other expenses. One of the lenders required a payment every two weeks, even though her Social Security check came monthly. She didn’t fully understand the interest she would be paying.

When Joan paid off her initial $100 loan, the lender told her she was now eligible for a $200 loan, even though her income had not changed. She accepted the loan and renewed the other two.

It wasn’t long before she could no longer keep up with the payments. When she was late with a payment, one lender cashed the check she was required to leave, causing an overdraft in her account and subjecting her to additional fees. She was not offered an extended repayment plan from any lender.

Now her loans are in the hands of other companies for debt collection, and they have informed her that the amount due has increased dramatically. One company said she now owes $219 on one of her $100 loans, without explaining the charges that caused her balance to balloon by more than $100 over the $117.50 due originally.

Joan’s contracts also ask whether she or her spouse is an active-duty member of the U.S. Armed Forces. While Congress has limited the interest rate to 36% per year for active-duty service members and their families, no such protections are in place for veterans or civilians. Her husband is an Army veteran who was honorably discharged, and the two feel that they, too, deserve protection from these predatory lenders – as do other civilians in their situation.

Joan and her husband hope that in the future those who are most in need of money, as they were this past summer, can be protected from the extremely high rates they encountered. “It’s price-gouging,” Joan’s husband said.

Joan wishes that she had known more about these loans and her other alternatives before walking into those stores. “I would never do this again,” she said. “Even if I needed money, I would rather let my lights turn off until I get the money to pay.”

LATARA BETHUNE DOTHAN

Latara Bethune and her husband run a small shop in Dothan where they cut and style hair, but she was unable to continue working during a high-risk pregnancy. She needed money to renew her car’s registration and insurance as well as to pay the power and phone bills. So she went to a title loan store.

After inspecting her car, the salesperson offered her twice the amount she requested. She was hesitant, though, and replied that she was worried about her car being repossessed if she fell behind on payments.

“No, we don’t work that way,” the employee told Latara, who was 27 at the time.

The employee explained that Latara would owe $100 per month but did not explain how many payments she would need to make or inform her about the fees that would be charged if she were late making a payment. The reality was, if Latara paid $100 per month, the terms of the contract ensured that she would be making payments for 18 months, paying back a total of approximately $1,787 for her $400 loan.

Latara was also charged between $2 and $3 per day when she was late and was sometimes called and threatened. One lender employee told Latara that if she did not provide the keys to her car, they would call the police and accuse her of stealing.

Scared and angry, she felt she had an impossible choice – face jail time and the loss of her car if she did not pay, or the loss of her phone and electricity if she could not pay her utility bills. “Without a phone, I can’t talk to clients. Without a car, I can’t drive the seven miles to work.”

Latara feels that she was tricked. She said the lender employees seemed sympathetic during her initial visit to the store and promised to work with her when money was tight. She is still working to pay off the loan but has started looking for another loan at a more reasonable rate to pay off the title lender and keep her car.

CIERRA MYLES DOTHAN

Cierra Myles had an income of only $39 per week through child support. She made extra money occasionally by helping out at her mother’s job, but her months of searching for a regular job had proven fruitless. When she needed money to keep the lights on and put food on the table for her children, she turned to a title lender in her neighborhood.

The salesperson there asked for minimal information and explained little about the loan terms. Cierra, who was 25 at the time, agreed to make monthly payments of $129 on a $700 loan secured by a car she had bought a few months earlier for $1,200. The employee never explained that the principal would need to be paid in full in 30 days unless the lender agreed to roll it over for another 30-day period. Rules about late and repossession fees also were never discussed.

She made the first several payments on time but then began to fall behind. She kept in touch with the lender, offering assurances that she would make her late payments soon. She was told everything would be fine.

But it wasn’t. Using the spare key she had been required to leave, someone came and repossessed her car.

She was then told she could get it back if she brought in the late payment. But when she arrived, the employees insisted she pay $1,000, an amount that included the remaining principal, interest and $200 repossession fee. A late fee was also accumulating daily. She had no way of obtaining the money.

Losing her car has been devastating for Cierra and her family. She lives in a city without dependable public transportation and must rely on friends and family members for rides or borrow vehicles to take her children to school and look for jobs. When she drives by the title loan store, she can still see her vehicle, waiting to be sold. “I feel embarrassed and upset every time I see my car behind that fence.”

EDWARD* BIRMINGHAM

Edward worked hard to secure enough money for retirement. Until he was 60, he worked for various companies around Birmingham, finding work as it was available. Once he got older, he started doing odd jobs for friends and neighbors. In the past, he was always able to make ends meet to support his large family.

In 2007, Edward, then 89, was receiving Social Security and earning extra money from the occasional odd job. He was approached by a younger relative who needed money to repair his car. Edward wanted to help but didn’t have the money. He decided to take out a title loan on his 1996 Buick Riviera. Edward didn’t have much experience with loans and banking, but he understood that he was borrowing $800, and with interest would pay back $1,000. He was sure he could pay the money back. Over the next five months, Edward paid $200 per month until he paid the $1,000 he thought he owed.

But the lender informed him that he still owed the $800 principal because he had been paying only the monthly interest. Edward said that if he had been informed of this before taking out the loan, he would have looked for other options or at least tried to pay the loan off earlier. Feeling angry and tricked, he decided not to pay any more money. Several weeks later, his car was repossessed. The Buick, worth about $2,500, was his family’s only means of transportation.

A friend who was a lawyer offered to help. But after studying the law, he was outraged to learn that charging a 300% annual rate is perfectly legal in Alabama.

Fortunately, his friend lent Edward the $1,200 need to pay off the principal, interest and repossession fee so he could get the vehicle back. That meant the lender had received a total of $2,200 for the $800 loan.

Edward said he will never take out a title loan again, and he hopes Alabama lawmakers will reform what he considers a dishonest business.

REGINALD INGRAM DOTHAN

Reginald worked hard to make a good life for himself and his family. With he and his wife both making enough money and in stable jobs, they decided to have a child.

But, in September 2011, less than five months before the baby was due, he was told the store where he worked as an assistant manager was closing in just 11 days. Reginald applied for unemployment benefits and started looking for any job he could find. His wife kept working part time, but they couldn’t make ends meet, even after cutting out non-essential expenses.

Over the next seven months, the period in which he was unemployed, he took out a series of payday and title loans totaling $1,575, struggling to keep up with interest payments and pay off the principal on some of the loans. At one point, the family went without electricity for three weeks.

When he couldn’t make payments, the lenders would cash the checks he left with them, which would incur overdraft fees. Reginald also received many calls from the lenders and collection agencies, who told him things like, “We’ll subpoena you to court on charges,” trying to make it sound like he could face criminal charges. They offered to let him off if he could pay more than three times the amount he owed.

Reginald paid $10 or $15 whenever he could. But even though he paid a total of about $1,900 in interest and principal, not including the money he paid in overdraft fees, he still defaulted on four loans.

A $3,000 title loan is still outstanding. His monthly interest payment is $300, so he tries to pay about $450 each month. Even if he keeps paying every month at this rate, he will pay approximately $2,200 in interest by the time the loan is repaid.

Reginald learned that payday and title lenders target those who are not able to pay their loans in the first month. “When you go in there, it’s almost like they’re fishing. You’re just bait. They don’t expect you to pay it off. They expect you to be on the hook to renew the loan over and over and over again.”

* NOT HIS/HER REAL NAME.

Buyer Beware

Alabama lacks the regulations and oversight necessary to ensure predatory lenders don’t take advantage of their customers, who are usually already facing financial distress. In fact, the standards – or lack thereof – more often favor the lender.

The following explains the regulatory environment for payday and title loans in Alabama.

PAYDAY LOANS

The Deferred Presentment Services Act, enacted by the Alabama Legislature in 2003, authorizes fees – effectively interest charges – of up to 17.5% of a loan, which can be due in as few as 10 days or as many as 30 days after the loan has been issued. Borrowers may receive as much as $500 with each loan. A typical loan is given for two weeks, as most people receive their paychecks on a bi-weekly schedule. Thus, a $500 loan incurs interest charges of $87.50 every two weeks, resulting in an effective annual interest rate of 456%.

When a loan is extended, the borrower either presents a check or authorizes an electronic debit for the principal value and interest charges, postdated for the day the loan is due. On that day, the lender may deposit the check or request the money from the bank. Borrowers with insufficient funds face a bad check fee of $30 from the lender and overdraft fees from the bank.

The Act also permits the lender to roll over the loan only once, at the same 17.5% interest rate. After that, it prohibits the lender from making an additional transaction with the borrower until the loan is paid and one business day has passed. However, the Act also provides that a lender can engage in another transaction with the borrower immediately if the borrower pays the total amount due on the previous loan with cash or “guaranteed funds.” Lenders use this provision to effectively renew loans by forcing borrowers to present the total outstanding amount in cash before immediately returning the same money – minus interest paid – in the form of a new loan. Thus, in practice, lenders engage in multiple rollovers of the same loan when consumers are unable to pay the full amount, causing consumers to make hundreds, or even thousands, of dollars in interest payments on one loan. Additionally, although the Act authorizes lenders to offer an extended repayment plan of four equal monthly installment payments if the borrower is unable to repay on time, the Act does not require lenders to notify consumers of this option or grant a borrower’s request for such a payment plan.

The Act prohibits a lender from “knowingly” extending a loan to a borrower who has any outstanding loans, from any lenders, that exceed $500 in the aggregate. However, it requires lenders to use a third-party private sector database to verify this information only “where available.” Lenders do not currently use a common database.

TITLE LOANS

No statute expressly addresses title lending in Alabama. However, the Alabama Supreme Court has found that the Pawnshop Act covers title lending, even though, unlike a traditional pawn, the borrower retains physical possession of the car and gives the lender possession of the title documents only. Conversely, all other states with similarly vague definitions of pawned goods have found that their states’ generic pawnshop acts do not authorize title pawns.

The Pawnshop Act authorizes a “pawnshop charge” and fees that amount to 25% of the principal per month. The Act provides for a loan term of no less than 30 days. There is no maximum loan amount, and lenders determine the amount extended based on the value of the car. Thus, borrowers can receive thousands of dollars. They may not be held personally liable for the loan.

Lenders are not required to provide extensive disclosures or explain the terms of the loan. Although the contract is required to include the maturity date of the pawn transaction, usually 30 days from the date of the contract, borrowers are also told they will have many months to pay off the full amount of the loan. Borrowers are often told that the interest rate is the “minimum monthly payment,” but are not told that just paying this amount every month will never reduce their debt. The law does not explicitly require lenders to disclose any other fees that may be added to the borrower’s total amount due, including late fees and repossession costs; these fees are often hidden in the contract through the use of deceptive language, or not included at all.

The law contains no limit on the pawnbroker’s ability to roll over the loans and charge additional interest. In practice, borrowers are virtually never able to pay the high amounts of principal and interest within one month and consequently must roll over the loan many times. The law also does not require the lender to roll over the loan every 30 days, so the lender can demand full payment when the borrower does not expect it.

If a borrower is unable to pay off the loan or extend it by the maturity date, the borrower has 30 days after the maturity date to redeem the title by paying the full amount due plus an additional charge equal to the original pawnshop charge. The Pawnshop Act does not explain when lenders can repossess the cars or what, if any, fees they can charge in doing so. Most lenders repossess during this 30-day period and charge a daily late fee. After 30 days, “absolute right, title and interest in and to the goods” vests in the lender, and thus the lender can sell the car. The Pawnshop Act does not explicitly direct the lender to return any money made on the sale of the car that exceeds the amount due on the loan.

Safeguards Needed

As this report illustrates, payday and title lenders prey on the most vulnerable Alabamians, trapping them in a nightmarish cycle of debt when they already face financial distress. They typically operate in low-income neighborhoods and lure unsuspecting borrowers with advertisements offering easy access to cash. They target down-on-their-luck customers who have little ability to pay off their loans but who trust, wrongly, that the lenders are subject to regulations that protect consumers from usurious rates and unfair practices.

These predatory lenders have no incentive to act as a responsible lender would. They have shown no desire to assess borrowers’ ability to pay; to encourage consumers to borrow only what they can afford; to explain loan terms in detail; to extend loan terms to encourage on-time repayment instead of rollovers; or to offer financial education or savings programs in conjunction with the loan.

Instead, their profit model is based on extending irresponsible loans that consumers cannot possibly repay on time. Policymakers must step in to ensure that these lenders can no longer drain needed resources from our most vulnerable communities.

The following recommendations should serve as a guide to lawmakers in establishing much-needed protections for small-dollar borrowers:

LIMIT ANNUAL INTEREST RATE TO 36%

An interest rate cap is necessary to limit the interest and fees that borrowers pay for these loans, especially considering that many of them are in debt for about half the year. A rate cap has proven the only effective way to address the multitude of problems identified in this report, as it prevents predatory payday and title lenders from exploiting other loopholes in the law. Many states have enacted similar caps, and Congress has enacted such a cap for loans to active-duty military families.

ALLOW A MINIMUM REPAYMENT PERIOD OF 90 DAYS

As the stories in this report show, a period of two weeks or a month is too short to provide a meaningful opportunity for repayment. The Federal Deposit Insurance Corporation (FDIC) noted after its pilot program in affordable small-dollar loans that a 90-day loan term is the minimum time needed to repay a small-dollar loan. In fact, this was the feature that most bankers in the pilot linked to the success of their small-dollar loan program. Another option for extending the loan term is to enact a mandatory extended repayment plan, which would allow all borrowers the option to extend their payments over a longer period rather than make one lump-sum repayment. However, policymakers must ensure that borrowers are informed of this option and can take advantage of it.

For title loans, an even longer repayment period may be necessary, depending on the amount of the loan. A longer loan term is necessary to prevent lenders from asking for the full amount of the loan after each 30 day period, despite telling consumers they will be able to make loan payments.

LIMIT THE NUMBER OF LOANS PER YEAR

A limit on the number of loans per year ensures that the product is reserved for the industry’s stated purpose of short-term, occasional use for borrowers facing unexpected budgetary shortfalls. The FDIC has also recognized the need to limit the amount of time borrowers are in debt with these high-interest loans and has instructed banks engaged in payday lending to ensure that payday loans are not provided to customers who are in payday loan debt for three months of any 12-month period. This loan cap should be accompanied by increased disclosure of the maximum number of loans, as well as a longer loan term or extended repayment plan so that borrowers will not default when they reach their limit.

ENSURE A MEANINGFUL ASSESSMENT OF BORROWER’S ABILITY TO REPAY

A borrower’s ability to repay should be considered in both payday and title loans. Any assessment of ability to repay should consider both a borrower’s income and additional financial obligations.

CREATE A CENTRALIZED DATABASE

A centralized database is necessary for enforcing the loan limits recommended in this report and those already enacted into law. It also facilitates reporting of loan data so that lawmakers and the public can better understand who uses these loans.

BAN INCENTIVE AND COMMISSION PAYMENTS FOR EMPLOYEES BASED ON OUTSTANDING LOAN AMOUNTS

The compensation model for many predatory lenders incentivizes employees to encourage borrowers to take out larger loans than they can afford and to continue rolling over these loans at the end of each loan period. This incentive system should be eliminated to prevent employees from coercing borrowers to remain indebted for months and instead encourage responsible lending and borrowing.

PROHIBIT DIRECT ACCESS TO BANK ACCOUNTS AND SOCIAL SECURITY FUNDS

Payday lenders’ direct access to the bank accounts of borrowers must be prohibited, as it allows lenders to evade protections for Social Security recipients and coerces borrowers to repay their payday loan debts before satisfying any other obligations. Congress recognized the abuses that can stem from this direct access and, for active-duty members of the military and their dependents, has prohibited lenders from using a check or access to a financial account as security for the obligation.

PROHIBIT LENDER BUYOUTS OF UNPAID TITLE LOANS

Lenders must be prevented from buying a title loan from another lender and extending a new, more costly loan to the same borrower. In order to encourage responsible lending, policymakers should not allow a lender to extend more money to consumers who have demonstrated an inability to repay a smaller loan.

REQUIRE LENDERS TO RETURN SURPLUS OBTAINED IN SALE OF REPOSSESSED VEHICLES

It is fundamentally unfair for lenders to obtain a windfall by retaining the full sum obtained from the sale of a borrower’s car after repossession. Requiring lenders to return the surplus will also temper the lenders’ incentive to repossess the car rather than work with a borrower on a repayment plan.

CREATE INCENTIVES FOR SAVINGS AND SMALL-LOAN PRODUCTS

The FDIC pilot program, which studied how banks could profitably offer small-dollar loans, was helpful in determining a template for affordable small-dollar lending. Additionally, the FDIC stated that Community Reinvestment Act examiners may favorably consider small-dollar loan programs when evaluating the institutions’ lending performance. Although the regulation of payday and title lenders should spur affordable lenders to enter the market, additional incentives should also be developed to encourage responsible products targeted at low-income consumers.

REQUIRE FINANCIAL EDUCATION AND CREDIT COUNSELING

Policymakers should ensure that the communities targeted by predatory lenders are also made aware of affordable small-dollar loan options and savings programs. This could include requiring payday and title lenders to distribute an approved list of credit counselors, alternative credit options and other emergency assistance options to consumers before they are given the loan agreement to sign, and providing financial education courses in low-income communities.

What Next?

If additional safeguards are enacted into law to protect consumers from predatory payday and title lending, some of the current lenders will likely move out of the state, claiming that new regulations are driving them out of business. This is beneficial to the community and inevitable when additional protections are established. Encouraging responsible lending will necessarily entail getting rid of the lenders that are unwilling to extend loans with terms that are fair to consumers.

If these lenders leave the state or become less available, low-income consumers will still have options at their disposal to deal with financial shortfalls. Many creditors will negotiate payment plans with borrowers. Also, borrowers may turn to friends or family for help instead of taking out a loan, which is something that many already do to escape predatory loan debt. Additionally, if these loans were not available, many borrowers would simply cut back on expenses.

In a July 2012 study based on a survey of payday loan borrowers, Pew Charitable Trusts found that most would choose options that do not connect them to a formal institution if payday loans were unavailable. In the Pew survey, 81% said they would cut back on expenses; 62% said they would delay payment of their bills; 57% said they would borrow from family or friends; and 57% said they would sell or pawn personal items. Only 44% of consumers would get a loan from a bank or credit union; 37% would use a credit card; and 17% of employed borrowers would get a loan from their employer.

North Carolina’s experience confirms these findings. In 2001, state legislators allowed laws that permitted payday lending at high interest rates to expire. Five years later, the attorney general reported that the last of the payday lenders in the state had agreed to stop making illegal loans. In a 2007 report commissioned by the Office of the Commissioner of Banks, survey responses and focus groups showed that the absence of storefront payday lending had no significant impact on the availability of credit for households in North Carolina. The most frequent options used by those facing financial shortfalls were paying the expense late or not paying, using money from a savings account, and obtaining money from friends or family.

Eliminating predatory lending products also allows responsible lenders to enter the market. From 2002 to 2006, the first four years that loans with annual interest rates above 36% were banned in North Carolina, there was a 37% increase in the number of loans made at or below 36% APR. The North Carolina State Employees Credit Union, the biggest in the state, created an alternative payday loan product with an annual interest rate of 12% and a savings plan. Similarly, after the Military Lending Act of 2007 limited the interest rate for loans extended to active-duty military personnel and their families to 36%, non-profits and military relief societies began offering interest-free loans. Many military credit unions and banks also began extending loans at low interest rates or with zero interest.

A pilot program conducted by the Federal Deposit Insurance Corporation also established a “safe, affordable, and feasible template for small-dollar loans.” Charge-off ratios, which represent the amount of debt the bank believes will never be recovered, were in line with the industry average. Most pilot bankers indicated that small-dollar loans were a useful business strategy for developing or retaining long-term relationships with consumers.

Already, many credit unions in Alabama offer 90-day loans at annual interest rates of 18% or lower. These credit unions will offer loans to borrowers with no credit or bad credit, requiring only that they are members of the credit union and can provide proof of income or direct deposit. If additional protections are enacted into law, other banks, credit unions and community organizations will step in to offer safe products to meet the demand for small-dollar loans.

Policymakers must regulate both payday and title loans to protect consumers from predatory lenders. Otherwise, Alabama lenders, many of which are engaged in both payday and title lending, will simply push their customers to take out whichever loan is more favorable to the lender under the new regulatory structure. Other states have seen this reaction to increased regulation. For example, in Arizona, when the payday loan law expired, more than 200 payday lenders filed licenses to operate as title lenders and encouraged their customers to shift to these loans. In Virginia, the number of title loans increased five-fold between 2010 and 2011 after restrictions on payday lending took effect in 2009. Policymakers must take a strong stand on protecting vulnerable communities by addressing both types of predatory loans.

Acknowledgements

The SPLC would like to thank the many individuals who helped with this project, especially those who came forward to share their experiences with payday and title lending. We would also like to thank the churches and organizations that helped facilitate educational presentations and meetings with borrowers, especially Beulah Baptist Church, the Center for Fair Housing, Common Ground Montgomery, the Lovelady Center, Legal Services Alabama, and the Ordinary People Society.

CREDITS

Author: Sara Zampierin

Editor: Booth Gunter

Designer: Russell Estes

Photography: David Bundy, Valerie Downes, Russell Estes

Researchers: Tiffanie Agee, Jose Cardenas, Jacob Denney, Max Lesko, Natalie Lyons, James Meadows, John Pollock, Terri Sharpley, Dan Siegel, Jay Singh, Jackie Smiley, Christine Sun, Logan Talbot, Phillip Ward

Letter to Richard Cordray

-Richard Cordray

Director, Consumer Financial Protection Bureau

1700 G Street, NW

Washington, D.C. 20552

March 11, 2013

Dear Director Cordray:

For decades, Alabama’s most vulnerable citizens have been targeted and abused by the payday and car title loan industries in the state. These poorly regulated industries strip hundreds of millions of dollars each year from hard-working communities. As you recognized when you visited Birmingham for a field hearing in January last year, Alabama has one of the highest concentrations of payday lenders in the United States. We also have more car title lenders, per capita, than any other state.

Recently, the Southern Poverty Law Center released a report, Easy Money, Impossible Debt: How Predatory Lending Traps Alabama’s Poor, to document the incredible harm that these industries inflict on communities throughout the state. The report, a copy of which is enclosed, is the product of numerous listening sessions and interviews across the state, and is one of few that tell the stories of actual borrowers as well as those who work in the industry. Through our focus on how these loans affect the lives of consumers in Alabama, we hope that state lawmakers and regulators at the CFPB will better understand the gravity of the problem in states where lenders are allowed to operate unchecked.

As you have recognized, some loans—those whose “success is based on a substantial percentage of users rolling over their debts on a recurring basis”—are “debt traps.” These products “trigger a cycle of debt whose substantial costs over time can disrupt the precarious balance of people’s financial lives.”[1] Our conversations with consumers across Alabama made it clear to us that both payday and title loans are the very embodiment of the evils you described.

The stories highlighted in the report include those of senior citizens trying to help young family members in need, a recent nursing school graduate trying to make ends meet, a military veteran’s family facing a tough time, and other hard-working families and individuals that were ensnared by these loans. Many have paid hundreds, or even thousands, of dollars in interest payments for initial loans of just a few hundred dollars. For example, Alicia, a nurse, repaid $2,945 in total for borrowing $1500 for a period of just a few months. Latara, a hairdresser, is still paying $100 per month to pay off her $400 title loan almost two years after it was issued. Unfortunately, Alicia and Latara’s experiences are all too typical of those who are induced to take out predatory loans.

The report also includes candid interviews from those who own and run payday and title lending stores. These interviews confirm that the business model of these industries is to encourage high loan amounts and multiple renewals. A former employee of a payday and title lender explained that she was paid on commission based on loan amounts outstanding, not including any loans in collections or past due. Indeed, she explained that employees were discouraged from allowing borrowers to pay off the loan amount: “When a borrower pays in full and doesn’t renew, you lose a check. They don’t want you to ever drop checks, and if you do, they want to know why.” As one owner of a local payday loan store acknowledged, “To be honest, it’s an entrapment—it’s to trap you.”

We are heartened that the CFPB has spoken out about these debt traps and instituted a comprehensive examination of small-dollar payday loans. We urge you to conduct an examination of car title loans as well. As we, along with other groups, explained at the community roundtable discussion CFPB held in Atlanta in January, and as the report explains in more detail, these loans have had the same disastrous effects as payday loans on the lives and financial stability of Alabama’s most vulnerable communities.

We also call on the CFPB to use its rulemaking authority to declare the most egregiously predatory practices of these industries as unlawful, unfair, deceptive, or abusive. In particular, the report identifies the following unfair business practices that should be the subject of reform:

–Repayment periods too short to allow for a meaningful opportunity for on time repayment. Borrowers must be allowed at least 90 days to save the money required to pay back the loan, and possibly even longer for more expensive title loans.

–Unlimited renewals.There must be a limit on the number of loans per borrower per year to ensure that lenders cannot collect interest on the same loan for months upon end without extending any new principal.

–Failure to meaningfully assess borrowers’ ability to repay. Lenders must be required to take income into account and to stop the practice of lending beyond what a consumer can afford to pay.

–Failure to utilize a centralized database and report data to the public. These industries must be forced to report data about the loans extended and outstanding in order to ensure compliance with current laws. States also must be required to produce data to the public to show how these loans are utilized.

–Payment of employees on a commission basis. Lenders must be prohibited from paying employees based on the outstanding principal value on all current loans, which encourages abusive practices such as offering higher loan amounts than consumers can afford, persuading borrowers to renew their loans multiple times, and threatening consumers in order to obtain a payment.

–Deceptive explanations of contracts, especially with title loans. Many title lenders currently explain the loan terms as requiring a “minimum monthly payment,” equal to the interest on the loan, so borrowers do not pay down the principal. Lenders must not be permitted to engage in such deceptive explanations.

–Direct access to the bank accounts of payday loan borrowers. The abusive practice of requiring a check or access to a financial account as security must be prohibited, as it is in the Military Lending Act. It allows lenders to evade protections on social security funds and allows banks to rack up overdraft fees for borrowers who have insufficient funds in their accounts.

–Lender buyouts of unpaid title loans. Many lenders will buy a title loan from another lender at the borrower’s request when he reports being unable to pay his first loan. The second lender then compounds the previously-owed principal, interest, and any late fees into principal on the new loan. Lenders should not be able to obtain higher interest payments from consumers in this abusive way.

–Retention of the surplus from the sale of repossessed vehicles. Lenders must not obtain an unfair windfall by retaining any surplus they obtain in the sale of the car that exceeds the current amount due on the loan.

Again, we hope that your rulemaking will extend to cover both payday and title loans in order to effectively protect vulnerable communities seeking small loans. The experience of states such as Arizona and Virginia has shown that when the payday loan industry encounters increased restrictions, lenders will simply switch to offering predatory car title loans instead.[2] We also hope that you will encourage programs that provide incentives for savings and small loan products and that require financial education and credit counseling options to be made available to the communities targeted by these industries.

We look forward to seeing your continued progress in this area as you work to ensure that the small loan market is helping, not hurting, consumers. Please do not hesitate to contact us if we can provide any additional information.

Sincerely yours,

J. Richard Cohen

President, Southern Poverty Law Center