Just in time for tax day, the white nationalist Social Contract Press has released a special report claiming that immigrants — legal and undocumented alike — are manipulating the Earned Income Tax Credit (EITC) to cheat taxpayers out of billions.

The report, “Defrauding the American Taxpayer — The Earned Income Tax Credit,” is packed with questionable assumptions and leaps of logic, undisguised racial and ethnic stereotypes, and some truly bizarre assertions, such as the suggestion that liberals have secretly colluded with Wal-Mart to undermine unions and the minimum wage. A thin veneer of economic argument against the EITC does nothing to hide that the report is typical Social Contract report fare, designed to stoke nativist and white nationalist fears about the day that the white majority is eclipsed.

In broad strokes, its claims — a mishmash of fact and conjecture — can be summarized thusly:

- The EITC, which enables low-income families to claim a tax credit for each child, serves as a “perverse incentive,” encouraging beneficiaries to have more children.

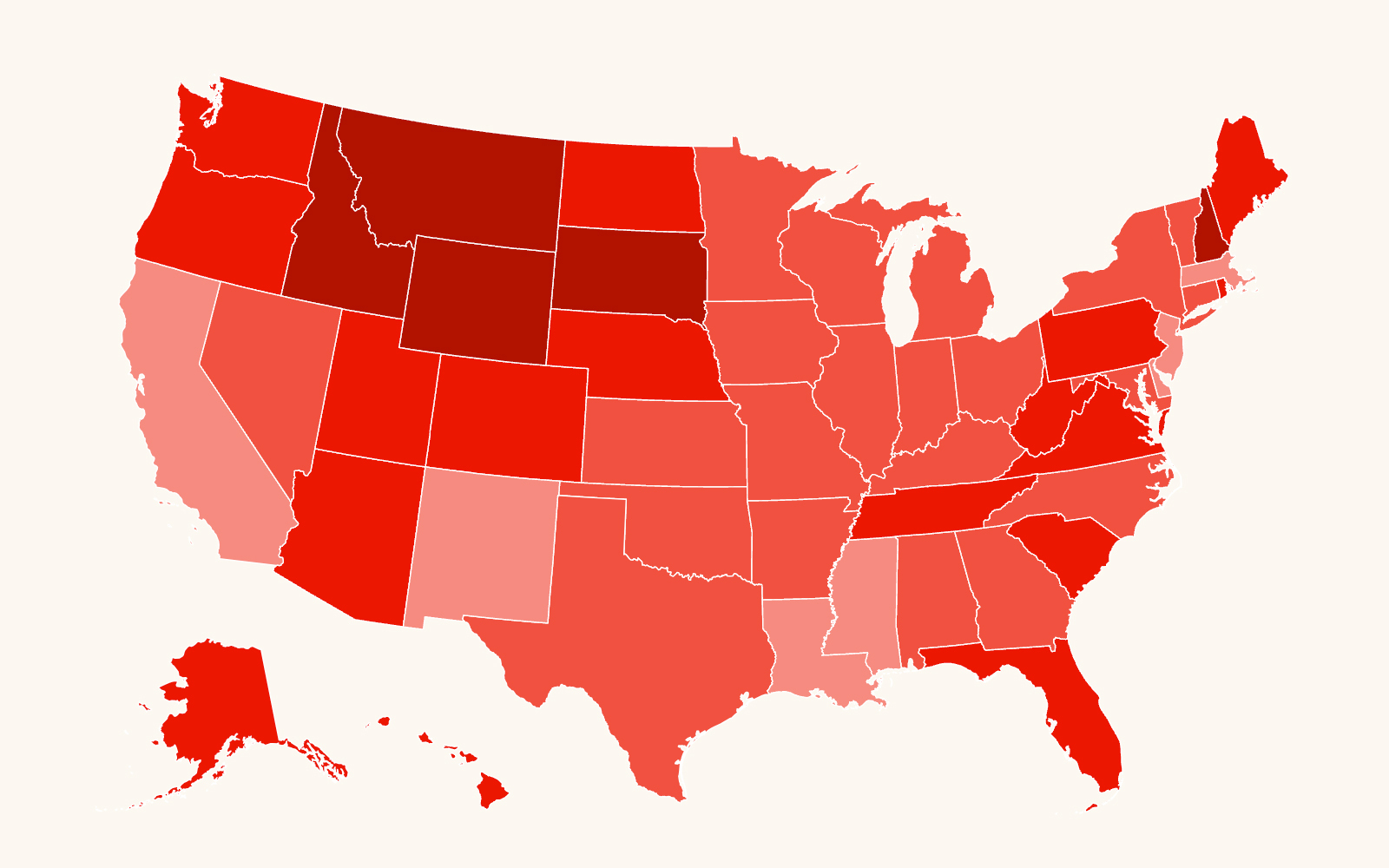

- A disproportionate number of EITC beneficiaries are immigrants and minorities, because poverty rates are higher among those groups. Combined with the significantly higher birth rate among Latino immigrants, the report reasons that the EITC is hastening the day when whites will no longer be a majority of the U.S. population.

- It is known that undocumented immigrants often use stolen Social Security numbers to apply for jobs. The report conjectures — but offers no evidence — that they must also be using these numbers to claim EITC benefits and otherwise defraud hardworking citizen taxpayers.

“While native-born women are having fewer babies, fertility among their foreign-born counterparts has generally continued to increase,” the report states. “The role of EITC in the nation’s demographic destiny cannot be denied.”

Sure it can — or, at the very least, debated.

By the report’s logic, the EITC encourages poor women to have more babies. Yet research shows that this presumption doesn’t hold true for all racial groups — suggesting that factors other than tax benefits determine birth rates.

According to a 2009 study published in the Journal of Population Economics, white women receiving EITC actually had fewer children than white women who did not receive the benefit, while minorities had more. Other studies have shown that Mexican women in Mexico — where there is no EITC — have more children than Mexican women who immigrate to America — again, suggesting that there are forces at work other than an American tax break when Mexicans plan their families.

The report repeatedly confuses correlation with causation. The fact that poor minority women are both more likely to receive EITC benefits and have high birth rates doesn’t mean the tax credit causes increased fertility.

Marc Rosenbaum, a senior policy analyst at the Migration Policy Institute, said that even though many undocumented immigrants use stolen Social Security numbers to apply for jobs, they are unlikely to use those numbers to claim benefits like the EITC for the simple reason that “it [would] open them up to investigations and being audited.” He added, “A lot of unauthorized immigrants make a point of paying their taxes, trying to establish a record of presence and employment.” But when it comes time to collect on the system into which they’ve paid, the risk simply isn’t worth it, he said.

The author of the Social Contract report, Edwin S. Rubenstein, is an economist and journalist with an Ivy League pedigree and conservative bona fides that include working for the Hudson Institute, the Manhattan Institute, Forbes magazine and the National Review. He is also a regular contributor to VDARE.com, a white nationalist website whose founder, Peter Brimelow, also once worked at the National Review and Forbes. The two have been writing together since at least 1997.

It’s no surprise that the Social Contract would draw on a VDARE contributor: the two white nationalist organizations frequently prop each other up. The publications are linked, as well, through Donald A. Collins, a frequent VDARE contributor who once sat on the board of Federation for American Immigration Reform (FAIR). FAIR’s founder is John Tanton, a Michigan ophthalmologist and the racist architect of the modern anti-immigrant movement. Tanton created the Social Contract Press and a constellation of other nativist organizations, including the Center for Immigration Studies (CIS), whose reports are a principal source of the dubious conclusions in Rubenstein’s report.

Rubenstein, despite making many claims about the fraudulent activities of undocumented immigrants, acknowledges that the Treasury Department’s recommendations for reining in EITC fraud make no mention whatsoever of immigrants.

The report also argues that “liberal activist groups” are pushing up the cost of the EITC by “partnering” with immigrants to perpetuate a fraud-ridden system, in part by publishing “[f]lyers in Hmong, Tagalog, and eighteen other languages – designed to hook immigrants into the EITC culture.”

Rubenstein ends with a peculiar bit of speculation about liberals and Wal-Mart. He postulates that by helping immigrants access the EITC, liberals enable giant corporations to underpay workers and discourage unionization.

“Why do liberal activists tout EITC and ignore other, relatively less-used, poverty programs? Why do they downplay the minimum wage? Are they in league with the Walmarts [sic] and McDonalds [sic] of the world?”

Not likely.