A private company contracts with a municipal court judge and the city of Gardendale, Alabama to create an illegal probation scheme that exploits low-income defendants and violates their constitutional rights, the SPLC said in a federal lawsuit and a judicial ethics complaint that were filed this week.

Gardendale Municipal Court Judge Kenneth Gomany and the city of Gardendale require anyone who cannot afford to pay their full fines and court fees for traffic and misdemeanor offenses to illegally be placed on supervised probation with the company, named Professional Probation Services, Inc. (PPS), the federal complaint states. The complaint further alleges that PPS, acting as a probation supervisor, owes a duty of neutrality and objectivity to those it supervises, but instead makes every decision to maximize profits, including the monthly fee it charges to defendants under its supervision.

The lawsuit was filed on Monday in the U.S. District Court for the Northern District of Alabama by two individuals who have struggled to pay and suffered under this private probation system. The lawsuit seeks damages and an order preventing the city, the judge and PPS from enforcing the contract and preventing the company from continuing to impose and collect its monthly fees.

The SPLC also filed a separate ethics complaint today with the Judicial Inquiry Commission of Alabama against Gomany for his part in the scheme, and for delegating judicial functions to PPS without ensuring due process when placing people on probation, or sending them to jail for non-compliance with probationary requirements. The ethics complaint also alleges that Gomany failed to protect other constitutional rights of defendants in his court, by failing to provide counsel to those who could not afford it, and failing to provide interpreters to those who did not speak English, among other violations.

“This private company is using a judge and a local government to illegally extract money for its own profit from low-income people who cannot afford their fines for minor offenses. This is a flagrant violation of law, and a blatant conflict of interest, as the company places profits over the interests of people it is supposed to impartially supervise,” said Sara Zampierin, senior staff attorney at the SPLC. “We are asking a federal judge to intervene to prevent further harm to individuals who are caught in this disgraceful scheme.”

Under a contract with the city of Gardendale and the Municipal Court judge, PPS has been granted exclusive rights to collect payments from people who cannot afford to pay their fines. The contract was not subjected to a public bid, as required under Alabama law for exclusive-franchise contracts.

When a person is sentenced in the Gardendale Municipal Court on a traffic or misdemeanor violation, Gomany asks the defendant if he or she can pay the entire amount before leaving the court. If the defendant cannot immediately pay the fines and court costs, Gomany enters an “order of probation” against the person, indicating that probation will be supervised until the individual pays their fees, court costs, and restitution to PPS.

Neither the judge nor PPS makes any attempt to evaluate the defendant’s ability to pay, nor do they explain that PPS is a private, for-profit company that will be collecting an additional monthly fee for this “service.” Neither the company nor the judge allows defendants to do community service as an alternative to probation, although that option is outlined in the contract with PPS.

During a meeting with a PPS employee immediately following the hearing, PPS sets additional conditions of probation. In addition to the fines and court costs set by the court, PPS requires those under its supervision to pay a monthly fee—typically $40—that is solely for the company’s profit. PPS also routinely extends the length of time of probation and sometimes even changes the fine amount owed to the municipal court—all of which increases the amount of time it takes individuals to pay off the court debt and monthly supervision fees owed to PPS.

PPS is completely unregulated by the municipal court. The company requires in-person check-ins to collect payments, and decides when a person should return to court for a “review date.” When PPS collects money, it takes its own monthly fee first, which extends the time a person must report. When the individual falls behind on payments, PPS requires them to check in every week, even if they have nothing to pay or have other obligations that make reporting difficult.

If a defendant continually fails to pay, PPS reports probation “violations” to Gomany for nonpayment or missed appointments, but omits any mention to the court of the person’s inability to pay, her reasons for not reporting, or that the appointments had been rescheduled. The consequence is often jail time, followed by further PPS supervision and fees.

Plaintiff Gina Harper, who lives paycheck to paycheck to support herself and her autistic son, was placed on probation with PPS in March when she couldn’t pay the $715 that Gomany assessed her for fines and fees. She had pleaded guilty to driving on a revoked driver’s license and was also sentenced to 48 hours in jail.

A painter at a sign company, Harper has tried to explain her financial situation to PPS and has requested community service numerous times. Gomany has made it clear that the court does not offer community service except at PPS’ discretion; PPS has denied her requests. After she fell behind on her payments, Gomany—based on PPS’ statements to the court about her non-compliance—ordered her to spend five days in jail. Harper is scheduled for another review hearing on Dec. 1. She has paid $90 and still owes almost $900—only $715 of which is for fines and court costs. The rest is owed to PPS for its monthly fees.

“I am afraid of going back to jail because the fees and costs that I could not afford in the first place keep going up,” Harper said. “And if I go to jail, I worry about my son’s well-being.”

The other plaintiff, Jennifer Essig, was placed on probation in July after she was sentenced to a $50 fine and $232 in court costs for trespassing. Essig told the judge she could pay $40, but not the entire amount right away, because she is on a fixed income and living in a motel. Without asking about her income and expenses, the judge ordered her onto probation with PPS to pay the remainder.

After she was jailed for 24 hours based on PPS’ false testimony that she missed several appointments, Essig was so scared of going back to jail that she used half of her monthly disability income to pay the remaining amount owed. PPS charged her for four months’ worth of service fees—$160—even though she was on probation for only two and a half months.

In March 2015, the SPLC filed a suit on behalf of three Clanton residents against the city of Clanton and another private probation company named Judicial Corrections Services (JCS), accusing that company of extorting court defendants under its supervision. In a settlement three months later, Clanton canceled the contract with JCS. Cities across Alabama also began canceling their contracts with the company and other private probation companies after the SPLC sent them a letter describing how their practices were illegal.

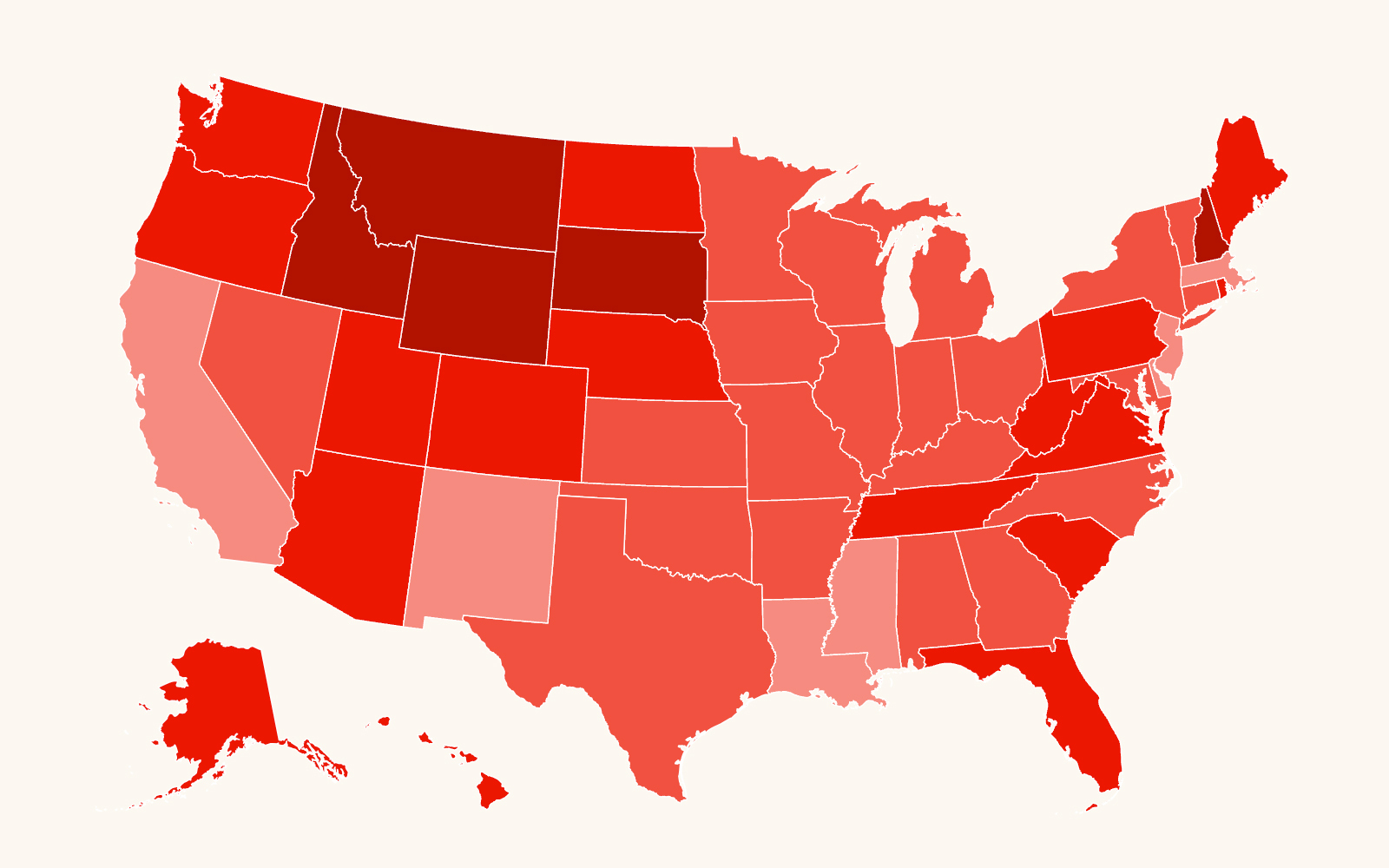

JCS no longer operates in the state of Alabama, but PPS—one of the largest private probation companies in the U.S—acquired JCS in January 2017 and reportedly supervises 50,000 individuals on probation in five states.