An investment company that is linked to an anti-LGBTQ+ hate group and is known for promoting data-driven “biblically responsible investing” recently settled a case brought by the Securities and Exchange Commission (SEC), which accused the firm of investing in companies that failed to meet the very standards it touted to its Christian-right base of clients and supporters.

More on ADF

April 9 – ‘Debanking’ conspiracy theory movement is led by Christian dominionists

May 20 – ADF adviser uses corporate activism to advance Christian supremacist agenda

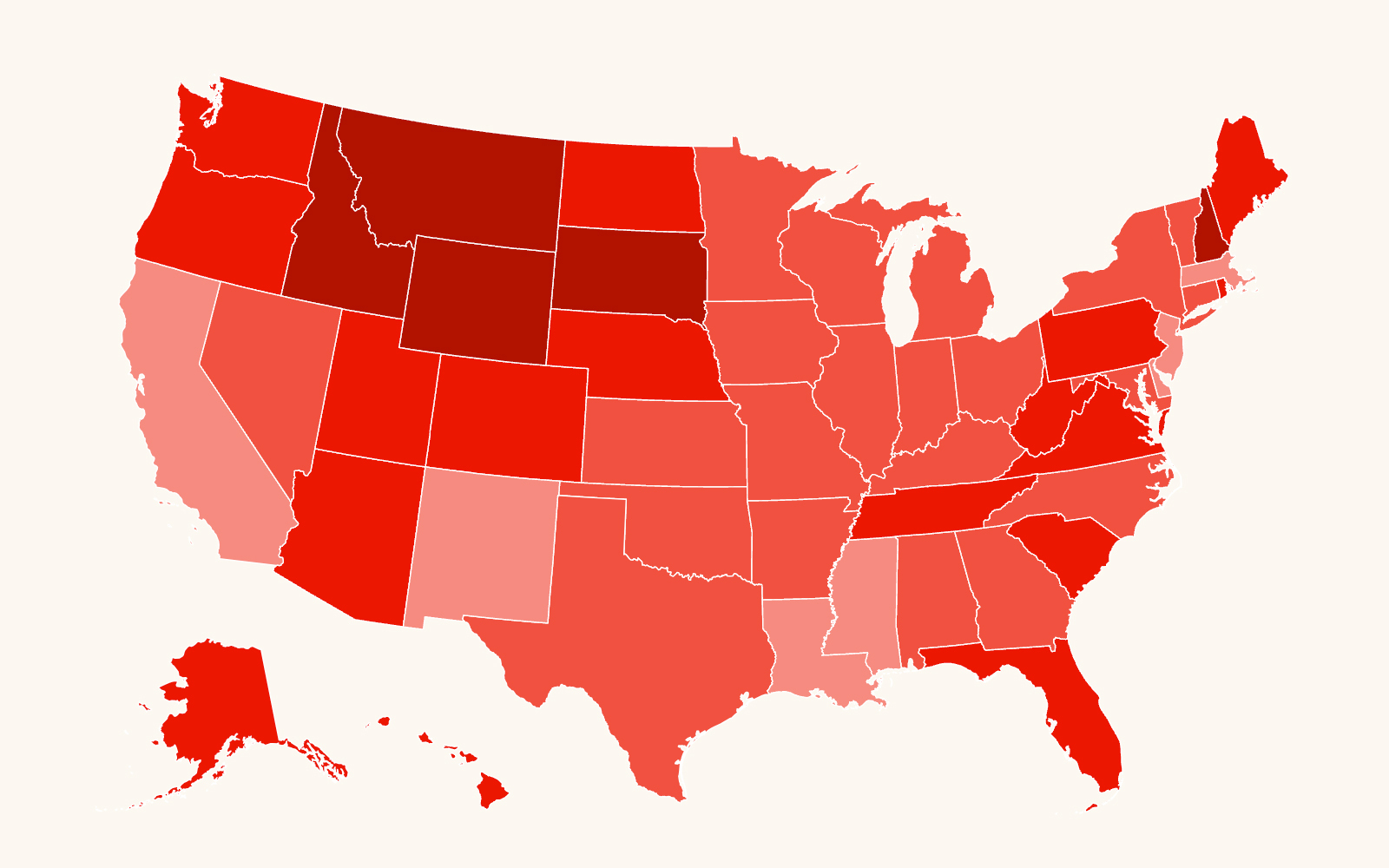

May 27 – State treasurers join Christian supremacist effort targeting public investments

May 29 – ADF supports donor, trade group for controversial health care sharing industry

Inspire Investing, an Idaho-based investment advisory firm, settled the case in September 2024 with the SEC. In a press release announcing the settlement, the SEC alleged that Inspire violated the antifraud provisions of the Investment Company Act of 1940 and the Investment Advisers Act of 1940. Without admitting to or denying the findings, the company “agreed to a censure and cease-and-desist order, to pay a $300,000 penalty, and to retain an independent compliance consultant,” according to the SEC.

Since 2022, Inspire Investing CEO Robert Netzly has been an adviser to anti-LGBTQ+ hate group Alliance Defending Freedom’s Viewpoint Diversity Score program, which characterizes corporate diversity and LGBTQ+ nondiscrimination protections as threats to white Christian men. Netzly and his firm have engaged in shareholder activism to end third-party fact-checking at Meta and the company’s diversity, equity and inclusion (DEI) policies.

Alliance Defending Freedom (ADF) is an anti-LGBTQ+ hate group that is engaged in an ongoing crusade to force private businesses to adhere to conservative Christian theology.

The Inspire Investing settlement highlights a movement where Alliance Defending Freedom (ADF) and a network of Christian Reconstructionist advisers have lobbied financial, economic and corporate entities, leading to the current abandonment of DEI policies and pushing Christian supremacy even further into all facets of American life.

SEC investigation

Inspire Investing is a Delaware-incorporated company registered with the SEC since 2017 and headquartered in Meridian, Idaho. It was founded by Netzly, who still serves as CEO. According to the SEC, in 2024, the company reported having approximately $2.5 billion in regulatory assets under management.

In biographies published by his previous venture, a company called Christian Wealth Management, and Inspire’s YouTube account, Netzly describes his work beginning in California. There he “discovered Biblically Responsible Investing through prayer and deep thoughts about Christian stewardship,” he wrote.

Since at least 2018, when he appeared at the Values Voter Summit (now called Pray Vote Stand) held by the anti-LGBTQ+ hate group Family Research Council (FRC), Netzly has been a prominent advocate for Christian-right political causes.

Inspire Investing follows Netzly’s “biblically responsible investing” strategy, which includes creating an index from metrics measuring a company’s compliance with Inspire’s interpretation of biblical values to “screen” its investment options. Archived copies of the company’s website show that in response to the question, “Does screening matter?” on its FAQ page, Inspire said, “If we say that we are against certain issues, like abortion or human trafficking for instance, then we should not be investing in those businesses in order to profit from them.”

According to the SEC, between at least 2019 and March 2024, the firm “represented” that it used a “data-driven methodology to evaluate companies” — a methodology the company refers to as the Inspire Impact Score. Archived webpages show a blog post from the company dating to at least 2018 that gives this description of its methodology: “Inspire utilizes advanced, artificial intelligence based technology to scrub millions of data points everyday from corporate reports, NGO’s, news articles and other sources to track and monitor a company’s impact on a daily basis.”

The company pointed to an unpublished white paper by a certified financial adviser who also authored content for Inspire’s blog between 2017 and 2022 that said, “Studies have found that implementing screens such as the Inspire Impact Score Methodology has benefited some portfolio returns and lowered portfolio risk.”

Along with screening out companies that it claims support abortion, Inspire claimed its “data-driven strategy” screened out support for “LGBT activism.” The company’s FAQ page denied “encourag[ing] discrimination.” The page says, “What we consider problematic is when a company decides to engage in LGBT activism, disregarding their employees and shareholders who hold a traditional view on marriage and sexuality.”

The SEC investigation found that Inspire “in fact relied on a manual research process and did not typically perform research on individual companies to evaluate them for eligibility under its investing criteria.” In addition, the SEC found the company “lacked written policies and procedures setting forth a process for evaluating companies’ activities as part of its investment process, which at times resulted in inconsistent application of its investment criteria.” The result, according to the SEC, was that from 2019 to March 2024, “Inspire Investing invested in companies engaged in activities that did not align with Inspire Investing’s own stated criteria and in which the advisory firm represented that it would not invest.”

In a Sept. 19, 2024, statement, Inspire Investing said that beginning in 2022, the company was included in a “non-public fact-finding inquiry” involving the SEC and that “the firm has already taken steps to address” weaknesses identified in the SEC order.

“The SEC Order takes no issue with the conservative, biblical values Inspire applies to screening categories,” the statement said. “Inspire remains committed to providing unapologetically biblical investment screening on issues of critical importance to faith-based investors around the world, including abortion and LGBT activism.”

Hate groups and the hypocrisy of shareholder activism

In addition to speaking at the FRC conference in 2018, Netzly has served as an adviser to ADF’s Viewpoint Diversity Score (VDS) program since 2022. VDS claims to use a data-driven approach to evaluating companies “based on 43 performance indicators that assess how companies’ commitments, policies, and practices in the market, workplace, and public square impact impact [sic] civil liberties,” according to its 2024 report.

On the VDS website, Inspire Insight, an online screening tool that uses Inspire Investing’s “proprietary Inspire Impact Score™ methodology that allows users to instantly measure the biblical values alignment of their investments according to Biblically Responsible Investing (BRI) principles,” is credited as a collaborator. The site states: “Viewpoint Diversity Score is a project of Alliance Defending Freedom. … Collaborating is Inspire Insight, a Christian financial technology firm informing investment decisions on billions of dollars around the globe.” Hatewatch has previously reported that ADF promotes white nationalist talking points to support its claims that corporations discriminate against white Christians.

In November 2024, Netzly joined with ADF advisers and Tim Wildmon, leader of the anti-LGBTQ+ hate group American Family Association, to cosign a letter to Fortune 1000 companies that claimed, “It is now a liability for any institution to tout adherence to DEI ideology” and warned, “The incoming [Donald Trump] presidential administration will no doubt hone in on this trend to hasten the demise of DEI.” The letter called on the companies to publicly distance themselves from DEI initiatives and programs and embrace a culture of what they call religious freedom.

In 2020, Netzly wrote an editorial for The Christian Post in which he criticized Amazon’s corporate board for recommending shareholders reject a proposal calling for the company to “issue a report … evaluating the range of risks and costs associated with discriminating against different social, political, and religious viewpoints.” According to Netzly, diversity on Amazon’s board of directors disguised a worldview that ignored conservatives.

“On the surface, Amazon’s Board of Directors seems rather diverse: Of the ten Directors, five are women and five are men; there are two people of color; and they each have varied backgrounds. … A look under the surface into the ideological perspectives of Amazon’s Board reveals a monolithically homogenous worldview committed to advancing a progressive-liberal political and social agenda,” he claimed.

In December 2023, Inspire announced it was joining a lawsuit against Target that claimed the company’s DEI polices “betrayed Target’s customers and shareholders and caused investors to lose billions of dollars.” In a statement, Netzly focused on the retailer’s LGBTQ+ pride campaign, calling it “reckless, ideologically motivated,” and damaging to shareholders. The suit was filed by Boyden Gray PLLC, a conservative Washington, D.C., law firm that regularly assists ADF in cases involving DEI policies, and America First Legal Foundation, a group founded by extremist Stephen Miller.

By 2025, Netzly has also claimed credit for pressuring Meta to end its third-party fact-checking program and its DEI policies. Ending independent fact-checking on the social media site, Netzly said in another Christian Post editorial, “will foster an environment of open dialogue and respectful debate that would not only restore trust but also enhance user engagement and shareholder value.”

Inspire Investing “demanded a seat at the table as Meta works through the details of their new content moderation policies to ensure the voices of Christians and others who share our conservative, biblical values are heard,” he wrote. “Two days after our meeting, Meta also decided to dismantle its divisive Diversity, Equity, and Inclusion (DEI) policies.”

Netzly also disclosed that Inspire had “submitted a shareholder resolution that is moving toward a vote at Meta’s annual shareholder meeting, challenging their censorship policies which many believed disproportionately targeted certain viewpoints, including those grounded in biblical values like pro-life and traditional marriage advocates.”

A review of Meta’s 2025 proxy statement shows no proposal by Inspire Investing.