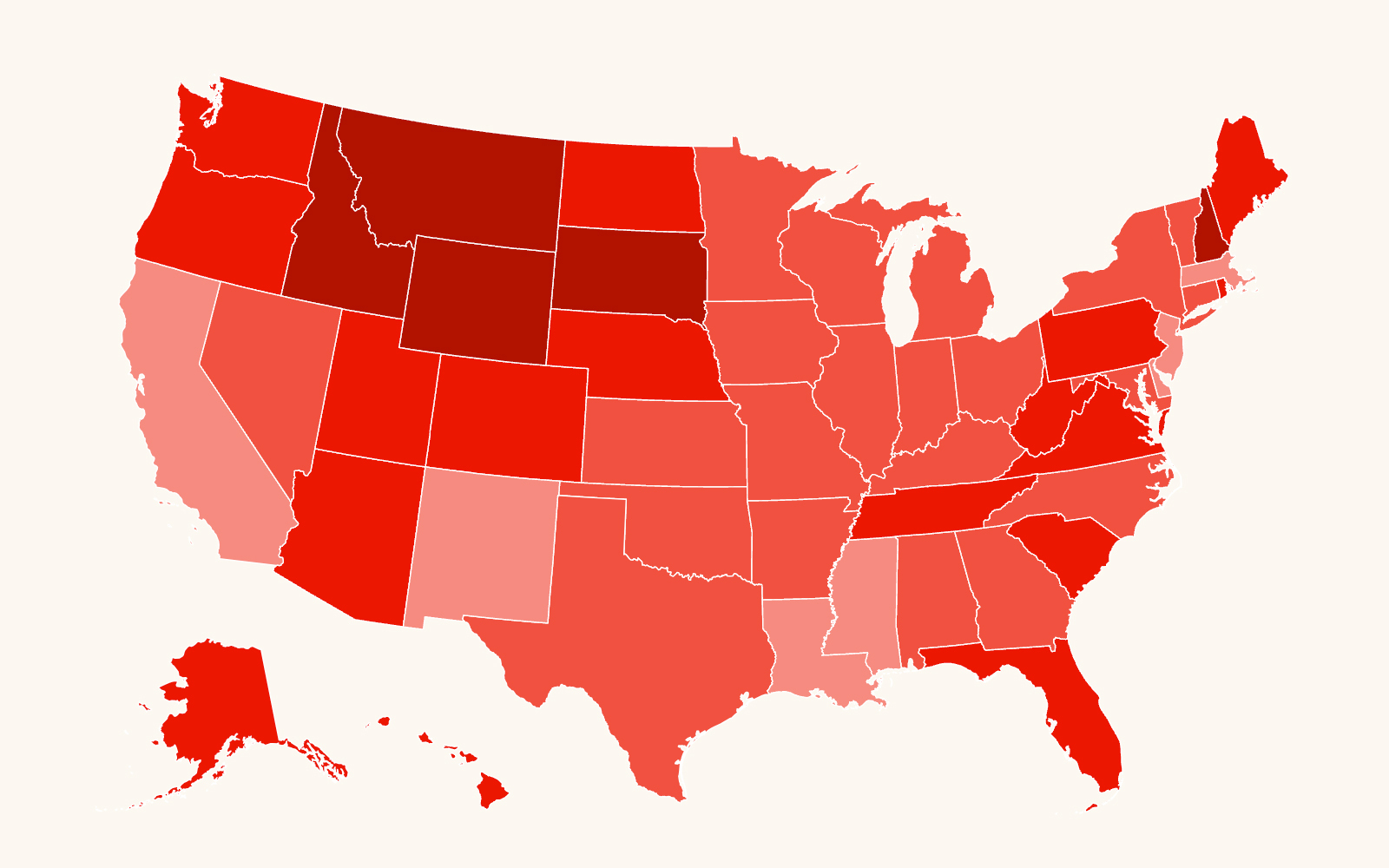

A sampling of hate crimes and hate group activities is summarized in state-by-state listings.

ALABAMA

Montgomery • Feb. 3, 2014

Former Klansman Steven Joshua Dinkle, 28, pleaded guilty to hate crime and obstruction of justice charges for burning a cross in a black neighborhood in Ozark, Ala., in 2009. Dinkle was the local leader of the International Keystone Knights of the Ku Klux Klan.

CALIFORNIA

Davis • March 14, 2014

Clayton Garzon pleaded no contest to felony assault likely to produce great bodily injury, felony hate crime and misdemeanor battery with serious bodily injury for beating a gay man in March 2013. Garzon received a split sentence in which he will serve five years in jail and then be placed on mandatory supervision for 28 months.

Marysville • March 25, 2014

White supremacist Billy James Hammett, 30, was sentenced to 87 months in prison for a 2011 racially motivated attack against a white man and a black woman. Hammett was also ordered to pay $175 in restitution and serve three years of supervised release following his prison sentence.

Sacramento • March 11, 2014

Anthony Merrell Tyler, 33, pleaded guilty to participating in a 2011 racially motivated attack on a white man and a black woman.

Sacramento • March 19, 2014

Reputed white supremacist Brian Keith Jones Jr. was convicted of first-degree murder in the fatal shooting of a black motorist in 2012.

San Jose • Jan. 7, 2014

Logan Beaschler, 18, pleaded not guilty to misdemeanor hate crime and battery charges after allegedly bullying his black roommate in 2013. Beaschler is one of several white students at San Jose State University accused of allegedly taunting their black roommate with racial slurs and hanging a bicycle lock around his neck. Joseph Bomgardner, 19, and Colin Warren, 18, also face misdemeanor hate crime and battery charges in connection with the incident.

FLORIDA

Deland • March 30, 2014

Flyers from the Loyal White Knights of the Ku Klux Klan were left at residences in a neighborhood.

ILLINOIS

Chicago • March 19, 2014

Joseph Firek, 59, was charged with first-degree murder and a hate crime for allegedly using racial slurs and punching Michael Tingling, 59, during a confrontation over inappropriate gestures Firek reportedly made to Tingling’s daughter. Tingling, a native of Belize, collapsed and died after the fight due to heart problems and stress from the altercation.

Orland Park • March 25, 2014

A bullet was fired through the dome of a mosque during a prayer service.

LOUISIANA

Eunice • March 22, 2014

Flyers from the Loyal White Knights of the Ku Klux Klan were left at residences in a neighborhood.

MISSISSIPPI

Oxford • Feb. 16, 2014

A noose was tied around the neck of a statue of James Meredith at the University of Mississippi. In 1962 Meredith became the first black student to enroll in what was then an all-white Southern college.

NEW YORK

Suffolk • March 24, 2014

Former Suffolk County Police Sgt. Scott A. Greene, 50, pleaded not guilty to six counts of fourth-degree grand larceny as a hate crime and other charges for allegedly stopping at least a half dozen Latino motorists and stealing their cash while patting them down.

NORTH DAKOTA

Leith • Jan. 24, 2014

White supremacist Kynan Dutton, 29, pleaded guilty to misdemeanor counts of menacing and disorderly conduct after he and fellow white supremacist Craig Cobb were accused of terrorizing residents while armed with guns in November. Dutton was sentenced to time served and two years of probation.

OREGON

Portland • March 11, 2014

White supremacist Holly Ann Grigsby pleaded guilty to racketeering in connection with a 2011 road trip that allegedly culminated in the murders of four people. Grigsby and her boyfriend, fellow white supremacist David Pedersen, allegedly killed Pedersen’s father and stepmother, a black man and a 19-year-old stranger who was singled out because they thought he was Jewish.

TEXAS

Fort Worth • Feb. 20, 2014

Brice Johnson, 19, was charged with willfully causing bodily injury to a person because of sexual orientation after allegedly beating a gay man in September.

Rhome • March 22, 2014

Flyers from the Loyal White Knights of the Ku Klux Klan were left at residences in a neighborhood.

VIRGINIA

Chesterfield • March 20, 2014

Flyers from the Traditionalist American Knights of the Ku Klux Klan were left in driveways of residences.